Debit Dashboard

The Challenge

Our debit cards were novel in the market and users struggled to understand how the physical and virtual cards worked. Users wanted more control over card locks, ordering and tracking cards, and discovery of features. These issues lead to excessive physical card losses, bad transaction experiences, and support costs.

My Role

Work with a Product Designer and Product Manager to identify discrete user problems.

Align product design team and stakeholders around an approach.

Develop prototypes and test various hypotheses to validate the approach.

Experiment design, testing and synthesis.

Process

Cross-functional workshop to develop hypotheses, align around principles, and to ideate and evaluate suggested approaches together.

Develop a content strategy for a debit management surface where users could learn the functionality, understand novel attributes, and take advantage of security measures.

Build unified functionality for card controls, make features accessible, and provide a clear card replacement process.

Make the system fault-tolerant and considerate of every state and use case.

Outcomes

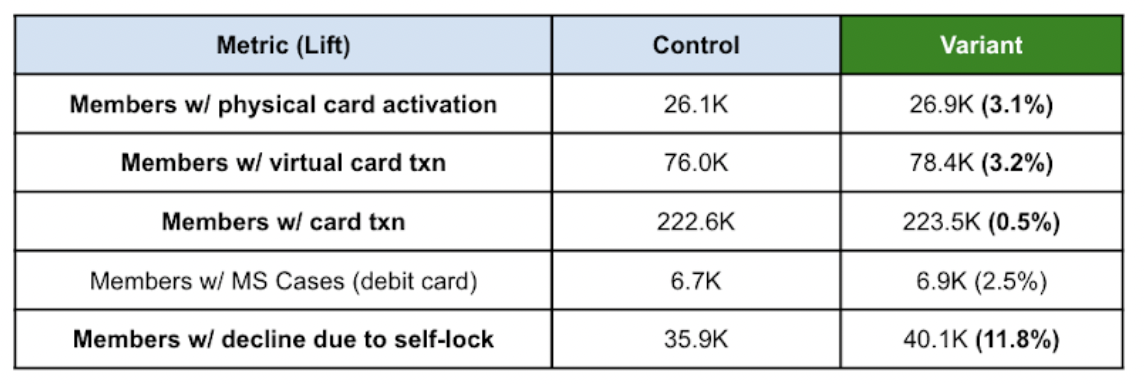

Increased card activations and virtual card transactions by 3%.

Reduced card-locked declines by almost 12%

Increased digital wallet adoption

Reduced support calls about debit card tracking

Problems

Users can manually lock their physical card but not their virtual card

Users are automatically sent a physical card even though it’s less secure and many don’t want it

Users didn’t know when their card would arrive or to what address, leading to expensive card losses and poor product adoption

Expensive support resources being used for actions available in-product:

Finding and using card locks (and understanding which card was locked)

Digital wallet adoption, usage and grooming

Reporting cards lost or compromised

Finding free ATMs

Research

Users value control over security

Common use cases included people locking a debit card and thinking it locked both debit cards

Many MS calls were related to changing PIN numbers and uncertainty around that functionality

Approach

A debit dashboard for managing debit cards

Fix virtual card usability problems and lock functions

Make virtual card and digital wallet usage easy and desirable

Make a self-service card replacement feature with a card-optional experience

Contextual navigation to ATM finder and Change PIN interactions

Card tracker system so users know when to expect delivery, how to activate the card, and can update their address

Outcomes

Success metrics were around virtual card adoption, card activations, reduced declines for manual locks, reduced card losses.

Increased card activations by 3.1%.

Increased virtual card transactions by 3.2%.

Increased physical card transactions by .5%.

Reduced members getting a decline while card is manually locked by almost 12%.

Increased digital wallet adoption.

Reduced support calls about debit card tracking by 2.5%.

Significantly reduced physical card replacement costs.